Long Term Capital Loss to be computed from Date of Possession of Property and not after Occupancy Certificate: ITAT

Omission of claiming long term capital loss in original return not bona fide so claim via revised return allowable

ET Money on X: "Now, let's discuss short-term capital gains. You cannot use the tax harvesting strategy on STCG Why?🤔 Because STCGs incur a flat 15% tax But you can use the

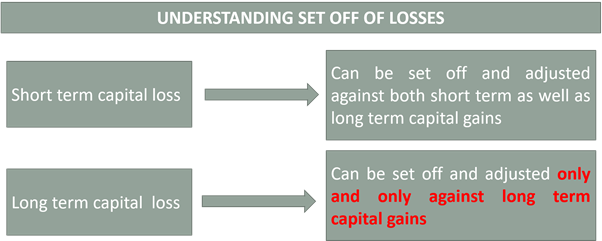

swapnilkabra on X: "Let us now understand how losses are set off in income tax. how losses are set off in income tax. 🔸Short term capital loss can be set off and

ITAT Upholds disallowance on account of Failure to prove Long Term Capital Loss arises from Sale of Share Of Company